How to Build a Professional Tax Consulting Website on WordPress

The tax consulting industry is experiencing a massive digital transformation. The global tax preparation services market reached $33.5 billion in 2024 and is expected to grow to $50 billion by 2031. In the US alone, the industry generated $14.5 billion in revenue in 2025.

Here’s what the latest data reveals about client behavior:

- Tax leaders are embracing digital transformation to deliver new value to businesses.

- AI-powered tax software can predict tax scenario outcomes with better than 90% accuracy.

- Organizations worldwide spent $18.5 billion on tax technology in 2024, predicted to reach $36 billion by 2030.

- The gig economy includes over 36% of U.S. workers in 2023, creating demand for specialized tax services.

Digital platforms are becoming essential for tax professionals. Tax authorities worldwide are increasingly adopting digital platforms to streamline tax reporting and communication. A professional tax consulting website has become the cornerstone of successful practices in this competitive landscape.

Key Takeaways

What you’ll master in this guide:

- Strategic WordPress setup for tax professionals

- Essential plugins that convert visitors into clients

- Tax software integration for streamlined workflows

- Local SEO tactics that dominate your market

- Client portal systems for secure document exchange

- Conversion optimization techniques that increase revenue

- Legal compliance requirements for tax websites

- Ongoing maintenance strategies for long-term success

Why WordPress is Perfect for Tax Consultants

WordPress powers 43% of all websites globally. It’s the perfect platform for tax consultants navigating today’s digital-first landscape.

Cloud technology is no longer a passing trend that companies are waiting to adopt; it’s a transformative force that businesses can’t afford to ignore. Tax professionals using modern web platforms report significant benefits:

- Reduced client acquisition costs through better online presence

- Streamlined client communication via secure portals

- Automated appointment booking and document collection

- Enhanced credibility through professional web design

This comprehensive guide shows you exactly how to build digital success. Technological proficiency is paramount for tax consultants in 2024. You’ll create a professional website that positions you ahead of competitors who still use outdated approaches.

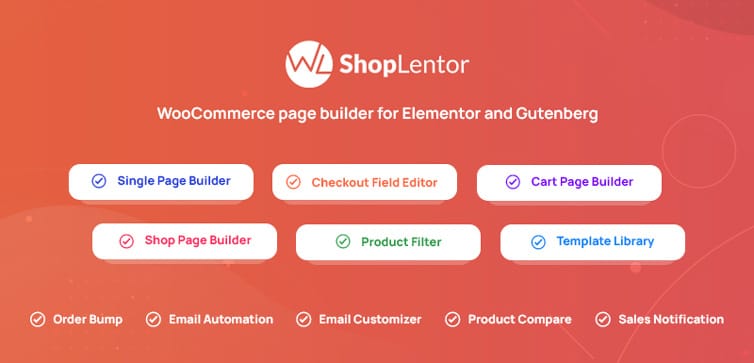

ShopLentor- WooCommerce Builder for Elementor & Gutenberg

A versatile page builder to build modern and excellent online stores with more than 100k+ Active Installations.

How to Build a Tax Consulting Website on WordPress: Getting Started

Domain and Hosting Setup

Choose a short, memorable domain name for your practice. Enable privacy protection to keep personal information secure.

Select reliable hosting with these requirements:

- PHP 8.2 or higher for optimal performance.

- HTTPS/SSL certificates for security compliance.

- Daily automated backups for data protection.

- Staging environments for safe testing.

Managed WordPress hosting simplifies initial setup completely. VPS or dedicated hosting offers more control options. Point your domain to a hosting provider and install SSL certificates. Confirm HTTPS activation works properly.

Essential Plugins for Tax Professional Websites

WooCommerce for Service Sales

Sell tax services and resources directly from your website. Create detailed product pages for different tax packages. Offer tiered pricing options to attract various client types.

Integrate secure payment gateways for smooth transactions. Accept credit cards, PayPal, and bank transfers safely. Set up automated invoicing and receipt generation systems.

ShopLentor for WooCommerce Enhancement

Enhance WooCommerce layouts with 100+ professional elements for service businesses. Create stunning pricing tables, comparison charts, and countdown timers for tax season urgency using ShopLentor. This plugin is perfect for showcasing tax packages with advanced filters and conversion optimization features.

Yoast SEO for Search Optimization

Optimize every page for search engines with keyword targeting. Write compelling meta descriptions that attract potential clients. Use readability checks to improve content quality.

Build authority with rich snippets and structured data markup. Help Google understand your services and location better. Monitor SEO performance with built-in analytics tools.

WPForms for Client Communication

Create custom client intake forms with drag-and-drop simplicity. Build appointment booking forms and contact pages easily. Secure all submissions with encryption and spam protection.

Design multi-step forms for complex tax questionnaires. Collect necessary documents and information before meetings. Send automatic confirmation emails to new prospects.

HT Easy GA4

Simplifies Google Analytics 4 implementation for tax websites without technical expertise. Automatically tracks client inquiries, service views, and conversion rates. Monitor peak inquiry periods during tax season. Essential for data-driven practice growth and marketing optimization.

LiteSpeed Cache for Performance

Boost site speed with advanced caching technology. Optimize images automatically to reduce loading times. Minify code to improve overall website performance.

Faster sites improve SEO rankings and user experience. Visitors stay longer on quick-loading websites. Search engines favor sites that load under three seconds.

Wordfence Security for Protection

Protect sensitive tax data with enterprise-level firewall protection. Run regular malware scans to detect threats early. Block brute force attacks automatically.

Monitor live traffic and suspicious activity patterns. Receive instant alerts about potential security issues. Keep client information safe and maintain professional trust.

UpdraftPlus for Reliable Backups

Schedule automated backups to multiple cloud storage providers. Quickly restore your website after errors or attacks. Test backup integrity regularly to ensure reliability.

Store backups in Dropbox, Google Drive, or Amazon S3. Set up daily, weekly, or monthly backup schedules. Restore individual files or complete websites easily.

Recommended Blogs for You:

👉 How to Optimize Your WooCommerce Product Pages for SEO and Conversions

👉 How to Track Keywords in Google Analytics(GA4 Tutorial)

👉 10 Best Web Hosting WordPress Themes 2025

👉 How to Design a WordPress Site That Will Impress Your Visitors

👉 10+ Best Accounting Software for Small Businesses

Recommended Tax Software Integration Options

Modern tax consultants use professional software for efficiency. These programs integrate well with WordPress websites:

- Intuit ProConnect: Cloud-based solution for individuals and businesses

- Drake Tax: Fast, accurate processing with compliance features

- Lacerte: Advanced capabilities for complex tax returns

- TaxSlayer Pro: Affordable option with a user-friendly interface

- UltraTax CS: Comprehensive suite for large accounting practices

Choose software based on your practice size and complexity. Consider client needs and integration requirements carefully. Most programs offer WordPress plugins or API connections.

Complete Website Creation Process

Step 1: WordPress Installation

Use your hosting provider’s one-click WordPress installer. Create secure administrator credentials with strong passwords. Configure basic settings, including timezone and permalink structure.

Set up user roles for team members appropriately. Install security certificates and enable automatic updates. Test admin access from multiple devices and browsers.

Step 2: Plugin Installation and Configuration

Install all essential plugins mentioned in the previous sections. Activate WooCommerce, Yoast SEO, and WPForms first. Configure security plugins before adding sensitive content.

Set up LiteSpeed Cache with recommended performance settings. Configure Wordfence firewall rules for tax websites. Test UpdraftPlus backup functionality before going live.

Step 3: Professional Theme Selection

Choose fast, finance-friendly themes like Astra or GeneratePress. Avoid heavy themes that slow down loading speeds. Look for mobile-responsive designs with clean layouts.

Import demo content or build custom layouts. Customize colors, fonts, and branding elements carefully. Ensure accessibility compliance for all visitors.

Step 4: Website Structure Planning

Plan your website pages strategically for user experience:

- Homepage with clear value proposition

- Services pages for each tax offering

- Pricing information and package details

- About page showcasing expertise and credentials

- Contact page with multiple communication options

- Blog section for tax tips and updates

- Secure client portal for document exchange

- FAQ section addressing common concerns

- Legal pages, including privacy policy and terms

Step 5: Service Offers and Packages

Create WooCommerce products for your tax packages. Offer individual services and bundled solutions. Use clear descriptions and competitive pricing strategies.

Set up seasonal promotions for busy tax periods. Create early bird discounts for advance bookings. Design comparison tables that clearly show package differences.

Step 6: Core Page Development

Build a compelling homepage highlighting your unique value proposition. Include client testimonials and professional credentials prominently. Add clear calls-to-action throughout the content.

Create detailed service pages for each tax offering. Explain benefits, process, and pricing transparently. Include frequently asked questions and next steps.

Step 7: Tax Software Integration

Add resources and guides for recommended software for tax professionals. Create comparison charts to help clients choose programs. Provide tutorials and support documentation links.

Set up affiliate relationships where appropriate and legal. Disclose any financial relationships transparently to clients. Focus on genuinely helpful recommendations only.

Step 8: Legal Compliance and Security

Enable sitewide SSL encryption for data protection. Create a comprehensive privacy policy explaining data handling. Add terms of service protecting your business.

Implement accessibility standards for disabled users. Include professional licensing information and credentials. Display required disclaimers for tax advice clearly.

Step 9: Performance and SEO Optimization

Configure LiteSpeed Cache for maximum speed improvement. Optimize all images for web display. Use Yoast SEO for keyword targeting and optimization.

Submit XML sitemap to Google Search Console. Set up Google Analytics for traffic monitoring. Create a Google My Business profile for local visibility.

Step 10: Testing and Launch Preparation

Test all contact forms and payment processing. Verify mobile responsiveness across different devices. Check website loading speed and fix issues.

Confirm backup systems work properly before launch. Test client portal access and security features. Review all content for accuracy and professionalism.

Advanced Optimization Strategies

Local SEO for Tax Consultants

Local SEO drives most tax consulting leads. Optimize your Google My Business profile completely. Add accurate business information, including hours and services.

Use location-based keywords throughout your website content. Create pages for each city you serve. Include local landmarks and neighborhood references naturally.

Collect and respond to client reviews regularly. Positive reviews improve local search rankings significantly. Address negative feedback professionally and promptly.

Build local citations on directories and review sites. Ensure consistent business information across all platforms. Partner with local businesses for referral opportunities.

Client Portal and Document Management

Set up secure client portals for document exchange. Use plugins like WP Client or ClientExec. Ensure HIPAA compliance for sensitive tax information.

Create organized folder structures for each client. Allow secure file uploads and downloads. Send automatic notifications when documents arrive.

Integrate appointment scheduling with calendar systems. Let clients book consultations directly online. Send confirmation emails and reminders automatically.

Conversion Rate Optimization Strategies

Use compelling headlines that address client pain points. Include specific benefits rather than generic statements. Add urgency elements during tax season appropriately.

Place contact forms strategically throughout your website. Offer multiple ways to get in touch. Use exit-intent popups for last-chance conversions.

Display trust signals like certifications and testimonials. Show security badges on forms and checkout. Include professional photos and team information.

Create lead magnets like tax checklists or guides. Offer valuable content in exchange for contact information. Build email lists for ongoing client communication.

Ongoing Maintenance and Updates

Schedule regular WordPress and plugin updates. Test updates on staging sites before applying live. Monitor website performance and loading speeds continuously.

Review security logs and backup integrity monthly. Update content with current tax law changes. Refresh testimonials and case studies regularly.

Monitor SEO performance and adjust strategies accordingly. Track conversion rates and optimize underperforming pages. Stay current with WordPress best practices.

Frequently Asked Questions

Should I recommend specific tax software on my site?

Yes! Clients trust consultants who guide them effectively. Recommend software based on genuine experience and client needs. Disclose any affiliate relationships transparently.

Can I earn commissions from software referrals?

Many tax software companies offer affiliate programs. Intuit, Drake, and others pay referral commissions. Always prioritize client needs over commission opportunities.

How do I compete with DIY tax software?

Position yourself as the expert maximizing software efficiency. Highlight complex situations requiring professional expertise. Emphasize accuracy and audit protection benefits.

Which plugins help showcase software features?

Use comparison table plugins like TablePress or WP Table Builder. Create interactive demos with embed codes. Include video tutorials and setup guides.

Is WordPress secure enough for tax data?

Yes, with proper security measures and plugins. Use encrypted forms and secure hosting providers. Follow HIPAA guidelines for sensitive information handling.

Final Words

Building a high-converting tax consulting website requires strategic planning. Combine professional design with essential functionality and security. Focus on user experience and conversion optimization.

Start with a solid WordPress foundation and reliable hosting. Add essential plugins before customizing appearance or content. Test everything thoroughly before launching publicly.

Remember that your website represents your professional expertise. Invest time in quality content and user experience. Monitor performance and continuously improve based on results.

A well-built WordPress website becomes your most effective marketing tool. It works around the clock, attracting and converting prospects. Follow this guide to create lasting business success.